by Lindsay Resnick, March 2, 2022

The is Part II of What’s Next for Medicare Advantage, offering a few observations and insights from the 2021-22 Annual Enrollment Period. The previous post, Part I - Frontline: Lessons Learned is available here.

Whether called ‘keys to success’ or ‘make it or break it time’ the following five challenges and opportunities are real. To be competitive in tomorrow’s Medicare Advantage marketplace plans need strategies for each.

Catch First-timers

On average 10,000 Americans turn 65 every day – THIS is Medicare Advantage’s new customer growth opportunity. While AEP will continue to be an important customer acquisition time of the year, fighting over fewer and fewer AEP switchers becomes a long, tough game to win. Individuals turning 65 choosing a Medicare plan for the first time and late market entrants (generally between ages 66 and 70) coming off an employer plan are the future of MA. For consumers, making the wrong Medicare insurance choice when they first enroll can not only be costly, but may mean they can’t get the best plan for them later. Plans with commercial Group and Individual business units have the extra advantage of capturing this ‘same brand’ existing customer cohort with an internal cross- over or cross-selling transition approach moving existing members to their Medicare products. Overall, the industry isn’t doing well here: only one-third of Medicare enrollees went to a plan with same group or individual carrier.

Grab consumers at their first Medicare enrollment decision, serve them well and plans can enjoy strong annual retention and profitable MA ROI. This is a year-round, always-on effort with significant LifeTime Value.

Leverage Retirement

The emotional charge around ‘retirement’ can be a persuasive response driver, supported by this eye-opening stat: A retired 65-year-old couple will need $300,000 for medical expenses…in addition to their Medicare coverage. Eighty percent of Americans age 65+ have a chronic condition and 68% have two or more. The link between retirement’s financial and healthcare concerns is extremely strong. In fact, one of the biggest post- retirement surprises cited by seniors is financial load of their Medicare coverage… I thought I planned for everything! Leveraging retirement planning into Medicare decision lead generation can be an effective direct response QOPC hook (Qualify, Offer, Product, Call-to-action). For example, ‘Take the Mystery Out of Retirement Planning‘ or ‘Financial Health in Retirement Depends on Your Medicare Choices‘ make compelling offers. Healthcare, long-term care and unexpected medical costs tops the list of retirement planning financial concerns...with both pre-retirees and retirees. It’s right up there with credit card debt, mortgage payments, savings, and Social Security.

Take the opportunity to speak with prospects at their “full” Social Security retirement: from 1943- 1954 it’s age 66, those between 1956-1959 its 66.4, and after 1960 full retirement age is 67.

Remove Friction

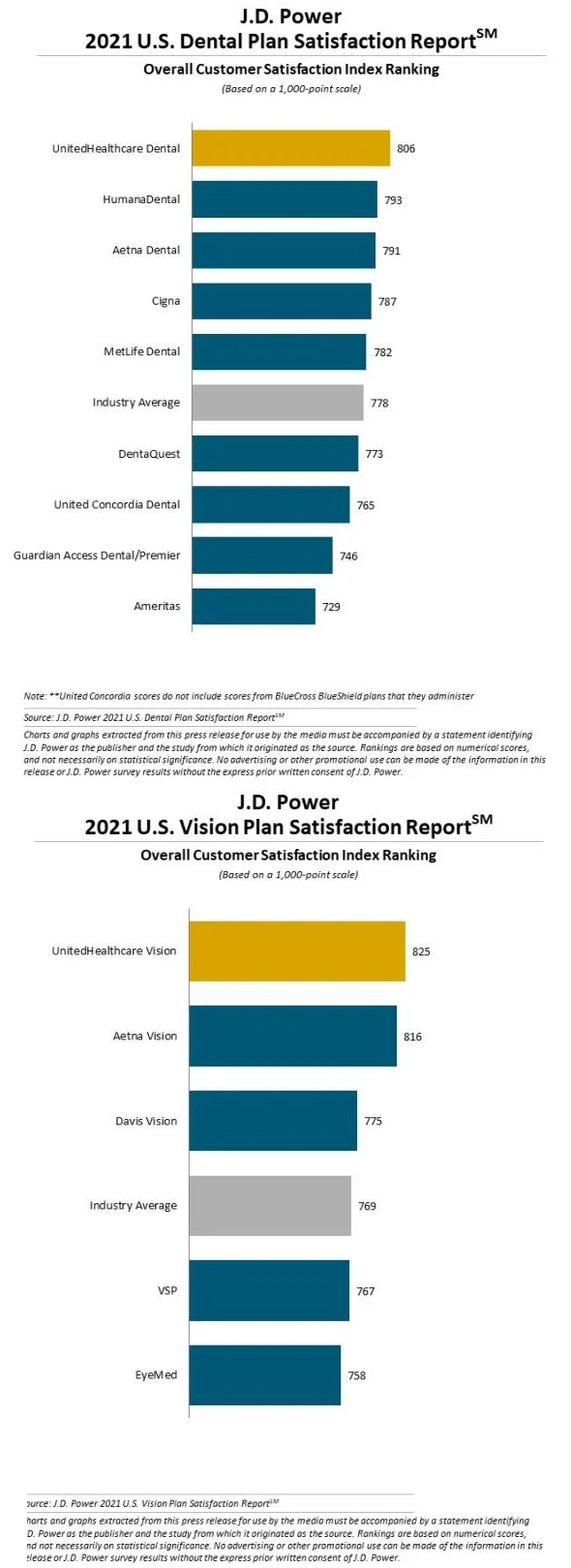

Again? Yes again…it’s time to deliver on high- performance customer experience/CX. Superior customer service goes a long, long way toward not only a top-level Star Rating, but it’s an essential part of customer retention and loyalty. Simply put: make sure the AEP switchers aren’t yours! Why pay the high price of acquiring new members just to see them walk out the back door? Investments in fixing and removing ‘points of friction’ throughout your MA plan, particularly inside your customer service organization, translate into improved profitability. And today, the bar is high. Even ‘satisfied’ customers walk out the door; ‘satisfactory’ performance is no longer enough to retain members---excellent, superior, first class and ‘the best’ need to be the plan’s goal. Once a plan has a ‘retention problem’ retroactively trying to keep members from leaving isn’t the answer. Rather, proactively delivering meaningful value and experiences that make members want to stay in the first place is a winning CX strategy.

CX represents an MA plan’s brand, it’s a marketable attribute that gets attention, and with recent adjustments to the new Star Rating guidance, having happy customers goes a long way.

Cultivate Partners

All the big retailers are in the Medicare game, either directly underwriting MA plans, selling plans through in-house agencies, or engaging MA customers through a branded primary care clinic or low-cost, convenience driven pharmacy service. During AEP these partnerships meant stores with high traffic area pop-up MA sales kiosks with agents and/or lead cards, co- branded Website tools and advertising, and pharmacist or clinic staff with “Ask Me About Medicare” buttons. For MA plans, it’s an if you can’t beat ‘em join ‘em moment to explore similar collaborative partnerships or joint ventures with national, regional, or local retailers. Collaboration is also being leveraged with providers. Either hospital systems or primary care physician networks sponsoring or affiliating with MA plans. Outside the strategic alignment that comes with this payer/provider relationship (aka Payvider), provider brand equity and trust can be a significant lead generation asset. Partnerships bring scale, which translates into financial and operating efficiencies, expanded market reach, and a better ability to address consumer demands for convenience, continuity, and consistency.

Teamwork makes the dreamwork. MA partnerships can yield big rewards: open new markets, extend product or service offering reach, and for consumers, better managed and more affordable health care.

Final Takeaway: Gut Check

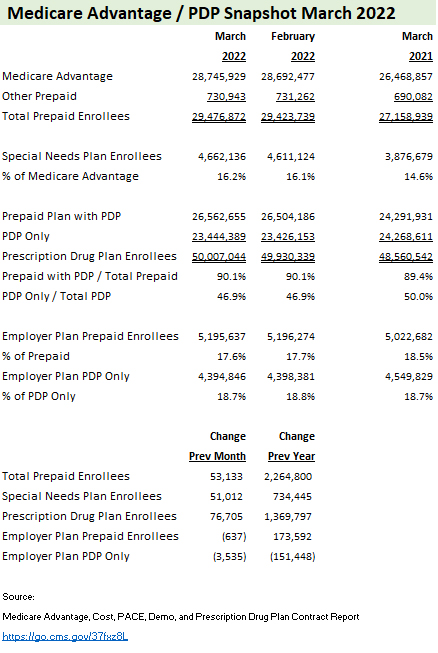

The Medicare Payment Advisory Commission (MedPAC), a panel that makes recommendations to Congress on Medicare policy, expects beneficiaries in Parts A and B enrolled in MA plans to stretch past 50% in 2023.

Staying competitive in an increasingly benefit- rich, fast-paced growth market challenges even the best in the business. As Medicare Advantage plans strategize around their 2022 market moves, meaningful brand and product differentiation matter more than ever. On the marketing and sales frontlines, deploying the full power of distinction quickly separates winners from losers…those plans headed toward growth and profitability rather than a slow decline into obsolescence.

There’s no better time than the start of a new year to do a MA marketing ‘gut check’, an assessment to validate MA marketing assumptions, resource adequacy and comparative industry best-practice “gap analysis” to identify important areas of improvement. Here’s a 10-point checklist to guide your assessment:

Share This Post

Share This Post