Springtime in Medicare Advantage Land

By Clive Riddle, April 9, 2021

The seeds are planted in the fall. Then as Spring arrives, you can assess what has been sowed. Or, as Mark Farrah Associates puts it: “Health insurers compete by offering new pricing and product options to beneficiaries during the Open Enrollment Period for Medicare Advantage (MA) and prescription drug plans (PDPs), that runs from October 15th through December 7th of each year. Plans then begin to analyze final enrollment results in February and March to evaluate their standing and assess which competitors gained and lost members.”

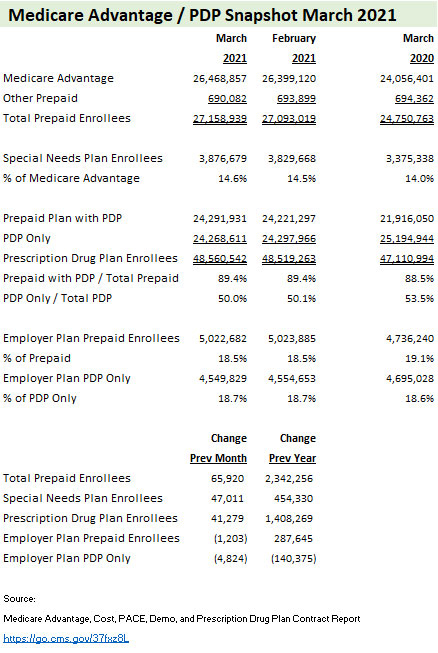

Here's a summary of MA and PDP enrollment that appeared two weeks ago in MCOL’s HealthExecSnapshot:

Mark Farrah Associates has just released their analysis of March 2021 MA and PDP enrollment. They report that “as of March 1, 2021, total Medicare Advantage (MA), including Medicare Advantage with Prescription Drug Plan (MA-PD) membership, stood at 27,158,911 with a net gain of 2,408,192 members from March 1, 2020. Medicare stand-alone prescription drug plans (PDPs) covered 24,268,611 members as of March 1, 2021, a net decrease of 926,333 from the previous year....MA plans grew by 9.7% while there was a -3.7% decrease for PDPs, year-over-year.”

They also note that:

-

The top ten carriers covered 77.6% of all MA enrollees, with UnitedHealth remaining the market-share leader.

-

Texas experienced the most sizeable year-over-year increase of almost 208,000 MA members.

-

Stand-alone PDPs experienced a decrease of approximately 926,000 enrollees between March 1, 2020 and March 1, 2021.

-

CVS, UnitedHealth, and Centene were the leaders amongst the top five companies that control 87% of the PDP market

Here are the top five national MA plans with their total March 2021 enrollment, % growth over March 2020. and national marketshare, from the Mark Farrah Associates report:

1. UNITEDHEALTH | 7,221,432 | 13.7% Growth | 26.6% Marketshare

2. HUMANA | 4,854,260 | 8.9% Growth |17.9% Marketshare

3. CVS | 2,860,379 | 9.2% Growth | 10.5% Marketshare

4. KAISER | 1,740,733 | 3.5% Growth | 6.4% Marketshare

5. ANTHEM | 1,530,894 | 15.4% Growth | 5.6% Marketshare

And here are the top five national PDPs from the Mark Farrah report:

1. CVS | 5,738,786 | 1.0% Growth | 23.6% Marketshare

2. UNITEDHEALTH | 4,507,985 | -7.0% Growth |18.6% Marketshare

3. CENTENE | 4,131,374 | -6.5% Growth |17.0% Marketshare

4. HUMANA | 3,556,348 | -5.9% Growth |14.7% Marketshare

5. CIGNA | 3,194,589 | -3.3% Growth |13.2% Marketshare

Share This Post

Share This Post

Reader Comments