Health Plan Medical Ratio and Administrative Expense Snapshots

by Clive Riddle, September 20, 2019

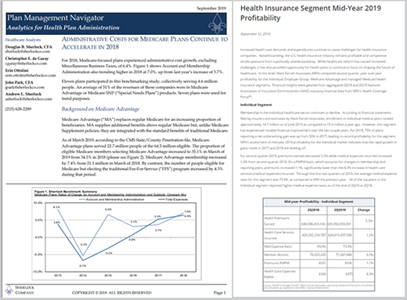

Two reports on health plan performance were released this week: Mark Farrah Associates issued an analysis brief providing insights into mid-year profitability for commercial and government lines of health insurance business entitled: Health Insurance Segment Mid-Year 2019 Profitability; and Sherlock Company's September 2019 Plan Management Navigator summarized cost trends among Medicare-focused plans.

Key findings from the Mark Farrah report on health plan profitability include:

- At the end of second quarter 2019, the average medical expense ratio for the Individual segment was 73.9%, as compared to 69.0% the previous year.

- Growth in medical expenses pushed the average medical expense ratio for the Employer-Group segment up to 81.4% for 2Q19 from 80.5% in 2Q18.

- For Medicare Advantage, premium growth outpaced increases in medical expenses pushing the medical expense ratio down to 84.7% from 85.5% in 2Q18.

- An increase of 9.7% in medical expenses per member per month pushed the medical expense ratio for Managed Medicaid up to 92.0% from 88.8% in 2Q18.

Their report concludes “at mid-year 2019, all four health care segments are signifying reduced levels of profitability for health insurers over 2018. Due to the minimum MLR constraints placed upon the individual segment, the stagnation of premium growth along with the rise in the mid-year med expense rations is not surprising, especially after the underwriting gains reaped in 2018.”

While Mark Farah Associates focused on profitability driven by medical expenses, Sherlock Company reported on administrative expenses and found that “for 2018, Medicare-focused plans experienced administrative cost growth, excluding Miscellaneous Business Taxes, of 6.4%. Account and Membership Administration [expenses were] also trending higher in 2018 at 7.0%, up from last year’s increase of 3.7%.

For Medicare-focused plans, they found “High cost Medicare Advantage grew at a median rate of 4.1%, Medicare SNP grew at a median rate of 5.7%, while low cost Medicaid increased at a median rate of 1.1%. The Commercial Insured product membership fell by a median rate of 2.1%, while Commercial ASO grew at a median rate of 3.5%. Overall, commercial membership decreased by 1.9%. Comprehensive membership in continuous plans fell by a median rate of 1.5%.

Post a Comment By

Post a Comment By  Riddle, Clive |

Riddle, Clive |  Friday, September 20, 2019 at 11:55AM tagged

Friday, September 20, 2019 at 11:55AM tagged  Cost & Utilization|

Cost & Utilization|  Finance|

Finance|  health plans

health plans

Reader Comments