By Clive Riddle, October 11, 2019

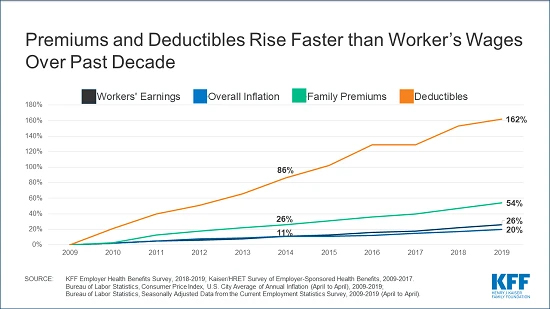

Much is being said about the increasing burden of employee health insurance cost sharing, which continues to far outpace employee wage increases and other cost of living indexes. The prevalence of high deductible plans is often cited as a significant factor adding to this burden. Perhaps not enough is being said about the prevalence of employers that do not make any or adequate account contributions for such high deductible plans, and the role of these absentee employers in adding to the employee burden.

The current issue of MCOL's ThoughtLeaders asks "What are the stakeholder implications going forward arising from employee health plan cost sharing increasing at twice the rate of wages during the past decade?”

Lindsay Resnick, EVP at Wunderman Thompson Health opens his response by telling us the implications "can be summed-up on one word: OOPS…Out Of Pocket Spending. As corporate stakeholders – providers, payers, pharma and employers – joust in a ‘Game of Thrones’ battle over payment schemes, network configurations, price manipulation, and bureaucratic machinations, what about the ultimate stakeholder, America’s healthcare customer. For them, healthcare has become an amalgam of medical, financial and lifestyle transactions where they’re searching for value and grappling with mind-numbing personal decisions."

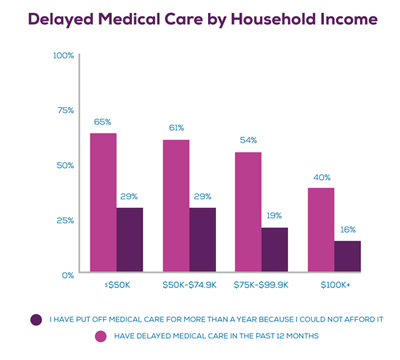

Natasha Elsner, Research Manager, Deloitte Center for Health Solutions comments that "high-deductible plans—that have become a common benefit option—are blunt instruments: they can discourage utilization of both low-value and high-value services, and such plans can be particularly challenging for people with ongoing health care needs, as well as those with low and even moderate incomes."

Dudley E. Morris, Senior Advisor, BDC Advisors notes that "compared to the press attention paid to Medicare-For-All, the escalating cost of large employer health plan insurance for working families is something of an elephant in the room in terms of the current political discourse."

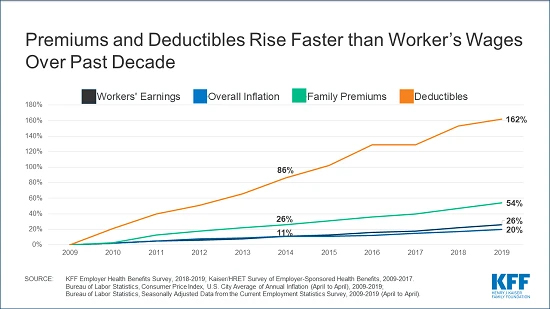

A couple of weeks ago Kaiser Family Foundation released its 2019 Employer Health Benefits Survey, Their comprehensive report found that “"despite the nation’s strong economy and low unemployment, what employers and workers pay toward premiums continues to rise more quickly than workers’ wages and inflation over time. Since 2009, average family premiums have increased 54% and workers’ contribution have increased 71%, several times more quickly than wages (26%) and inflation (20%)."

Section Eight of their 238-page report covers “High-Deductible Health Plans with Savings Option.” They found that 28% of firms offering health benefits offer a HDHP with a HRA (Health Reimbursement Account) or Health Savings Account (HSA). 30% of covered workers are enrolled in an account based HDHP (20% in 20140; with 7% in HRAs and 23% in HSAs. The average general deductibles for HDHP/HRAs was $2,583 for single, and $5,335 for family, and the average firm contribution being $1,713 for singles (67% of the deductible) and $3,255 for family (61% of the deductible.) The HRA employer contribution could certainly be worse (although it should be noted HRAs are not portable after the employee leaves the company.)

The problem is that for HSAs, the contribution is worse, and that’s where most of the enrollees are. The average general deductibles for HDHP/HSAs was $2,476 for single, and $4,673 for family, and the average firm contribution being $572 for singles (23% of the deductible) and $1,062 for family (23% of the deductible.) It isn’t that all employers are miserly - the KFF report notes that “there is considerable variation in the amount that employers contribute to savings accounts.”

But the bigger problem beyond employer contributions averaging under one fourth of the deductible requirement, is that 55%pf employers offering qualified HDHP/HSA plans do not make any contribution. Many of these employers are small businesses, meaning the percentage of total employees receiving a contribution is better, but still – 25% of total single employees receive no contribution and 26% of families receive no contribution.

Looking at the contributions on a total dollar basis for all HSAs, the Devinir Midyear HSA Market Statistics & Trends report found that 31% of 2019 HSA contributions come from employers (52% from current employees, 13% from individuals, and 3% from IRA rollovers and Other.)

The problem caused by Absentee Employers and Miserly Employers when it comes to account contributions, is that the true promise and potential of consumer choice and engagement in health care decision making is severely compromised when the consumer doesn’t have the financial resources to make and engage in the options available. It is one thing for a consumer to make selections taking cost into consideration when they have an account that can fund an adequate portion of the cost involved – and their decisions involve allocating those funds and retaining any savings for future healthcare needs. If is quite another to make those decisions when they are burdened by deductibles that have skyrocketed over the past decade without the backing of adequate employer account contributions and don’t have the personal resources to cover that gap.

Post a Comment By

Post a Comment By  Riddle, Clive |

Riddle, Clive |  Thursday, November 4, 2021 at 09:21AM tagged

Thursday, November 4, 2021 at 09:21AM tagged  Consumers|

Consumers|  Surveys & Reports|

Surveys & Reports|  health plans

health plans