by Kim Bellard, March 28, 2013

The New York Times recently published an interesting article, “The Face of Future Health Care,” that raised questions about whether even a model like Kaiser is delivering what we need to reform our health care system. It’s the old “be careful what you wish for…” dilemma.

After all, Kaiser could be considered a prototype for what ACA wanted when it created Accountable Care Organizations (ACOs). It is a fully integrated hospital-physician organization, delivering care and managing risk with salaried physicians and other health care practitioners, and its own hospitals. Hospitals all over the country are rushing to build their own versions, buying up physician practices at a record pace – one survey indicated that 52% would do so this year, while another predicted 75% of physicians would be so employed by 2014.

Kaiser may not have been the first integrated delivery system, nor are they the only one, but they certainly are the largest and have been around for decades. With all those decades, though, one would expect they would be dramatically lower in cost, and that is not generally the case. San Francisco public radio station KQED did a report “Why Isn’t Kaiser Less Expensive?” last spring. In their report, critics accuse Kaiser of shadow-pricing, while Kaiser’s CEO George Halvorson insists they don’t and are usually at least 10% cheaper. That’s nothing to brag about: with even 1% lower annual trend, they should have gotten 10% cheaper in these early years of the 21st century alone.

All this is not to pick at Kaiser. I have long admired models like Kaiser, Geisinger Health System, Group Health Cooperative of Puget Sound, Intermountain Healthcare, or The Mayo Clinic. It just seems intuitively obvious that like an integrated system, without the same incentives to overtreat that are pervasive elsewhere, should produce better results. Each of the systems has been fairly successful in their core markets, although less so the further away from home they get, yet none are delivering radically different cost or quality results than other providers.

And, really, why should they? They only have to be a little better each year than their competition. The new mantra in health care is “value-based purchasing,” but we’re a long way from there. The Catalyst for Payment Reform reports that only 11% of payments to doctors and hospitals are based on performance, while the Commonwealth Fund reports that less than 1% of health insurance premiums was spent on quality improvement in 2011. This is disappointing but hardly surprising. Most purchasers are buying with essentially house money; that is, someone else’s money.

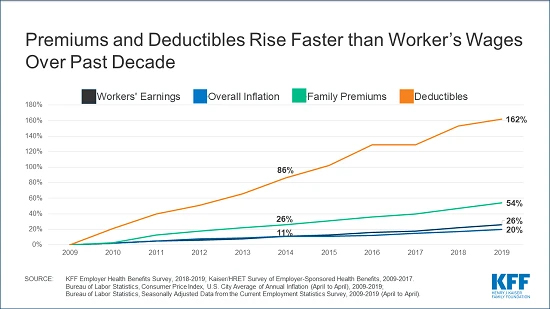

The biggest sources of health coverage are Medicaid, Medicare, and employer-sponsored health insurance. The persons covered under all of these are largely shielded from the true cost of that coverage. Medicaid is funded entirely by taxes, Medicare is also largely tax-funded, even when considering beneficiaries’ lifetime contributions, and, of course, employer coverage has the tax preference. The “tax expenditure” for employer health insurance is, by far, the largest such expenditure – more than twice as large as the mortgage deduction, for example. It’s all just compensation to employers; money “contributed” to employee benefits is simply money not spent on employee wages. The tax preference helps shield employees from how much is being spent on their behalf, and it creates a huge disparity with people buying individual coverage, who receive no tax break.

ACA doesn’t equalize the tax preference, but it does introduce a vast set of new subsidies for individual coverage. The Society of Actuaries has recently reported that individual premiums may be 32% higher due to ACA, joining the chorus of warnings about what may start happening in 2014. Even HHS Secretary Sebelius now acknowledges they may be higher, but notes that the new subsidies will offset much of these. While I think it is good public policy for more people to be covered and for economically disadvantaged people to get assistance in making coverage affordable, I worry greatly about creating a large new class of people sheltered from the true cost of health insurance. It’s making a bad situation much, much worse.

Steve Brill has gotten much deserved attention for his lengthy and insight Time article “Why Medical Bills Are Killing Us.” Brill painstaking walks through the crazy world of health care prices, especially their inconsistency between payors. Some have used his work to call for single payor or other rate-setting, while I would argue that the system is a symptom of what happens when no one is paying enough attention to prices.

Frankly, I question whether the ACO/integrated delivery system is going to be the solution to our health care mess. Hospitals are like factories: full of capital-intensive equipment and expensive to operate unless run at capacity. Yet they aren’t really run like modern factories in terms of management practices, as a recent study in JAMA pointed out. Similarly, physicians and other health care providers have some definite income expectations and fixed overhead obligations.

All too often, combining hospitals and other providers in integrated delivery systems may be more about consolidating market power or assuring current revenue levels than about improving the cost and quality of the care for patients. One AEI scholar recently pointed to the “humongous monopoly problem in health care,” and that’s with ACOs still in an early stage. AEI is not the first to cite this issue, as I’ve written about previously, but I still don’t think enough attention is being paid.

We’re moving quickly to a health care system that features geographic provider monopolies or cartels, consumers too shielded from costs, and a regulatory environment that creates larger barriers to entry for new competitors in either delivery or financing of care. That’s the perfect storm for a disaster.

For radically different results, we’ll need radically different approaches. Clayton Christian wrote about disruptive innovation in health care over ten years ago, and yet we’re still waiting to see it. It may mean breaking the health/medical connection that HMOs led us to try to integrate in health coverage, giving consumers more fiscal accountability for the former while still protecting them from catastrophic expenses that can result from intensive medical interventions. It should mean putting more of the data and technology – like mobile apps -- in the consumers’ hands, as advocated by people like Eric Topl (The Creative Destruction of Medicine) or Joe Flowers, and using that data to measure performance and help prescribe treatment.

We’ve had a very paternalistic health care system, with health care experts telling us what care we need and other experts choosing coverage for us. Let’s hope we can change that. We need consumers engaged, taking responsibility, and demanding accountability from providers. We need new types of competitors, using 21st century technology and science, to help consumers manage and finance their health needs.

We have to make sure that legislation and regulations focus on what’s best for the patient, not necessarily for existing health system entities, in order to help ensure we don’t stifle innovation (e.g., FDA regulation of mHealth). The facts that traditional Medicare benefit design is still largely based on 1960’s Blue Cross Blue Shield designs, or that, generally speaking, you can’t use telemedicine to consult with an expert physician in a different state due to licensing or coverage restrictions, amply illustrate the problem.

Whatever the future health system looks like, it won’t look like what we have today. Dinosaurs were remarkable effective for hundreds of millions of years, but the environment dramatically changed and they became extinct. A lot of the dinosaurs that have historically been the basis for our health care system will become extinct in the new health care environment, or evolve beyond recognition. As with evolution, it will be messy, proceed with many false starts, and produce unexpected winners.

Personally, I can’t wait to see what the future looks like.

Post a Comment By

Post a Comment By  Riddle, Clive |

Riddle, Clive |  Friday, June 25, 2021 at 07:40AM tagged

Friday, June 25, 2021 at 07:40AM tagged  Employers|

Employers|  Surveys & Reports

Surveys & Reports