High Deductible PPO Plans Versus CDHPs

By Clive Riddle, March 8, 2013

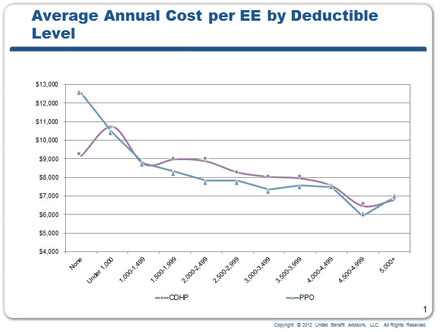

United Benefit Advisors has just released results of their annual health plan survey, with responses from 11,711 employers sponsoring 17,905 health plans nationwide, with results applicable for small to midsize companies. The survey includes a focus on Consumer Driven Health Plan (CDHP) vs. PPO comparisons of premiums, deductibles and enrollment. Their study found that “Consumer-driven health plans (CDHPs) -- high-deductible health plans (HDHPs) often paired with health savings accounts (HSAs) or health reimbursement accounts (HRAs) -- are not achieving long-term savings greater than what would be reached by raising the deductible on traditional PPOs.”

Unlike most national large employer benefit consulting firms, UBA – whose survey concentrated on smaller firms – is not bullish on account based plans, and would rather place their bets on straight PPO plans with a higher deductible. Although one could argue, it might be easy to make a stripped down high deductible PPO health plan yield immediate lower costs than a CDHP that has account administration costs, up-front wellness benefits and other bells and whistles. That doesn’t necessarily mean the PPO HDHP would be the best long term solution for an employer’s and employee’s objectives, unless immediate premium costs is the only concern.

UBA CEI Thom Mangan tells us “Employers are turning to CDHPs as a cost-cutting solution against the relentless upward spiral of health care costs. However, our research shows that small-to midsize businesses in particular, who may be considering these plans may first want to consider increasing the deductible on the plans they already have to achieve the same initial savings. Or, prior to implementing a CDHP plan, employers should build a culture of health and wellness in their workplace that drives employee behavior towards quality, low cost medical care and prescription drugs.”

Here’s some of the data UBA has shared from their findings:

- Nearly 60 percent of the 11,711 employers surveyed said they plan to offer a CDHP in the next five years

- PPOs remain the dominant plan type with 61.7 percent of U.S. employee enrollment

- The greatest savings of a PPO over a CDHP was achieved with a deductible of $2,000-$2,999, where PPO cost per employee was $7,811 and CDHP was $8,859, a savings of $1,000 per employee.

- Savings created by CDHPs over the plans they were replacing or HSA, averaged 1.75 percent in 2012, a significant reduction from prior years.

- Enrollment also decreased to 15.6 percent (a 1.8 percent decrease from 2011), and nationwide enrollment among employers with 1,000 or more employees dropped substantially from 15.9 percent in 2011 to 11.3 percent in 2012.

- The area of the country that has seen the biggest increase in CDHP growth is Minnesota, which saw the percent of employees enrolled in CDHPs increase from 15.5 percent in 2010 to 37.1 percent in 2012, a rate 18.4 percent higher than the national average in those same years.

- Other areas with rapid CDHP growth include Indiana, Virginia and the Northeast region. The only western state to see CDHP popularity increase was Oregon, where percent of employees enrolled in CDHPs increased from 12 percent in 2010 to 20.3 percent in 2012.

- Overall, CDHP enrollment in the west is the lowest in the country with only 7.7 percent of employees covered, a slight increase from 7 percent in 2011 and 4.6 percent in 2010. HMOs account for 31.3 percent of the market in the west.

Post a Comment By

Post a Comment By  Riddle, Clive |

Riddle, Clive |  Friday, March 8, 2013 at 09:09AM tagged

Friday, March 8, 2013 at 09:09AM tagged  Benefits & Premiums|

Benefits & Premiums|  Employers|

Employers|  Surveys & Reports|

Surveys & Reports|  health plans

health plans

Reader Comments