Two Reports on Cost Driven Deferred Medical Care

By Clive Riddle

Two reports were published this week on deferred medical care driven by cost considerations, based on survey findings. Earnin’s report: Waiting to Feel Better: Survey Reveals Cost Delays Timely Care is based on two surveys – a commissioned online Harris Poll among over 2,000 U.S. adults and an Earnin poll of their users, “many of which live paycheck to paycheck.” AccessOne’s report: AccessOne Patient Finance Survey- Analysis on how healthcare costs impact is based on a survey conducted by ORC International of 693 people with at least $35,000 in annual household income, weighted by age, sex, geographic region, race and education.

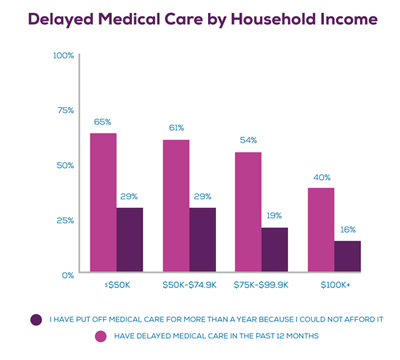

Earnin tells that 54% of Americans “have delayed medical care for themselves in the past 12 months because they could not afford it, “ with the top three most delayed types of care being dental/orthodontic work (55%), eye care (43%), and annual exams (30%.) Earnin reports that “23 percen) have put off getting medical care for more than one year because they could not afford it. Among those whose household is living paycheck to paycheck or not making enough to get by, the rate of this extremely delayed care averages 36 percent. Nearly half of Americans (49 percent) say their health tends to take a back seat to other financial obligations.”

- 21% of families who had trouble paying their medical bill reported that their accounts had been sent to collections.

- More than half of respondents were concerned about their ability to pay a medical bill of less than $1,000; with 35 percent being concerned about paying a bill that totals less than $500 – 20 times less than the average healthcare balance of a person in the U.S.

- Only 21 percent of respondents said their healthcare providers have spoken to them about available patient financing options in the past two years.

- Fifty-five percent of those surveyed said they prefer to discuss healthcare costs and financing options before care of service is delivered.

- Fifty-four percent of those surveyed said they would use a no-interest financing option for a balance of $1,000 or less, and 57 percent said availability of a no-interest finance option is important or very important in evaluating a provider.

Post a Comment By

Post a Comment By  Riddle, Clive |

Riddle, Clive |  Friday, October 26, 2018 at 10:30AM tagged

Friday, October 26, 2018 at 10:30AM tagged  Consumers|

Consumers|  Cost & Utilization

Cost & Utilization

Reader Comments