Managing the effects of pandemic-induced burnout among healthcare professionals

By Dr. Seleem R. Choudhury

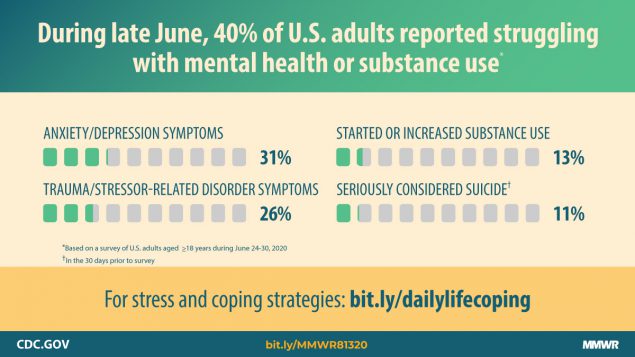

As the COVID-19 pandemic continues, healthcare workers face unprecedented levels of stress, fear, and anxiety. Situations that trigger chronic stress have always been present within the important and weighty work of caring for patients, but routine stressors are now intensified by the serious risks of working on the frontlines of a pandemic. Together, this creates a perfect storm of heightened risk of burnout.

Accounts of non-healthcare workers experiencing burnout from the challenges of working during a pandemic, such as learning to work remotely, constant technological mediation, and navigating new family schedules, are well documented. Though the phenomenon of burnout among healthcare professionals stretches back decades, the literature and recent data for U.S. healthcare workers during the pandemic is scarce (Jha, Shah, Calderon, Soin, & Manchikani, 2020).

Burnout: definitions and warning signs

The term “burnout” emerged in the early 1980s, and is defined by psychologists as “exhaustion that workers can experience when they have low job satisfaction and feel powerless and overwhelmed at work” (Mathieu, 2012). A definition from a recent study by Dr. Sachin Jha, et al., emphasizes the root cause of burnout as long-term job stress, resulting in a “mixture of fatigue, cynicism, and exposure to inefficacy” (2020). Though often thought of as a form of primarily emotional exhaustion, the impact of burnout can go beyond mental health, manifesting in physical ailments (Figley, 1995).

Burnout among healthcare professionals specifically has long been a concern. The Bureau of Labor Statistics projects 200,000 RNs will be needed per year over the next six years. But, according to Nursing Solutions Inc., since 2015, the average hospital has turned over nearly 90 percent of its workforce—these are all pre-COVID-19 numbers (2020).

Although burnout has been around for many decades, it has been exacerbated by the unique challenges of the pandemic, and exposes the insufficient methods that have historically been used to mitigate the symptoms of burnout among healthcare workers.

COVID-related burnout

Numerous personal accounts and experiences regarding providing care during COVID include feelings of being overwhelmed and powerless. According to a survey of nearly 60,000 nurses by the National Order of Nurses, a French nursing union, 57 percent of France’s nurses have described their condition as a “state of professional exhaustion” since the beginning of the pandemic (2020).

In the U.S., median self-reported stress, measured on a scale from 0 to 10, among intensive care unit clinicians increased from 3 to 8 during the pandemic (Society of Critical Care Medicine, 2020).

There are many root causes of the skyrocketing levels of burnout during the pandemic. Feelings of powerlessness are practically inevitable when, despite you and your colleagues’ constant efforts to fight the virus, you continue to see the same symptoms and give the same diagnosis repeatedly.

An article from researchers at Texas A&M University explains other sources of stress:

“Health care workers are experiencing added stress from multiple areas. Many of them are working longer shifts and experiencing more loss of life. The lack of personal protective equipment (PPE) and training on how to use new equipment causes many professionals to question if they have been exposed. This leads to fear that they could infect their family and loved ones. In addition to those fears, there is anxiety surrounding job security. To reduce the spread of infection, many states have stopped elective procedures and consequently, many health care professionals have been laid off or had their hours reduced” (Salazar, 2020).

Additionally, Amnesty International has released new data showing that an estimated 7,000 health workers have died due to COVID-19 around the world so far (2020). As of September 2020, the United States has suffered the second-highest death toll worldwide with 1,077 health workers dying from COVID, while the United Kingdom has the next-highest number of deaths at 649 (McCarthy, 2020). Working in such a high-risk job—especially when you entered into the profession assuming that it would not cost you your life—must have an impact on an individual's psychological well-being.

Responding to burnout

These are stressful times to be a healthcare professional. At all times, but especially under current circumstances, it is essential to be proactive to remain healthy mentally and physically and prevent burnout.

Individuals may benefit from the following strategies:

- Focus on meaning. Remember why you chose the healthcare profession.

- Try to set boundaries. In a global pandemic this is especially challenging, but where possible set time to disconnect from work.

- Strengthen your resilience. Take a 5-minute breather. Focus inward through journaling, yoga, etc.

- Practice mindfulness. Many studies show that mindfulness programs mitigate burnout symptoms.

- Stay positive, but also be realistic. Burnout is worsened when you expect too much of yourself.

- Practice gratitude. Gratitude has the power to improve our psychological health. Studies have shown it increases personal and professional well-being, boosts happiness, and helps to prevent depression (Chowdhury, 2020).

- Reach out to trusted peers or friends and talk it out (Rogers, Polonijo, & Carpiano, 2016).

Though individuals must recognize the importance of guarding themselves against burnout, healthcare organizations bear a great weight of responsibility in caring for their employees, creating an empathetic and supportive work environment, and providing resources to help their employees cope with the stresses of the pandemic.

Organizations should consider adopting the following strategies:

- Where possible, make sure that staff and providers have the necessary resources and skills to meet expectations. This is a crucial consideration, especially in regard to PPE.

- Organizations must understand that if staff and providers are working many hours, burnout is inevitable, and so provisions and appropriate support must be provided (Centers for Disease Control and Prevention, 2020).

- Organizational leaders need to express authentic empathy (Moss, 2020).

- There should be a robust support mechanism that is known, supported, and promoted consistently by leaders. This process needs to be ready to employ when a staff member expresses a need (Moss, 2020).

- Ask the question: “Are you doing ok?” Pause and listen for the response. Don’t be afraid to hear what is said, and don’t take the response personally. Associate no stigma with struggling with burnout.

- Prioritize and organize workloads. Be sensitive to what is happening and ensure that priorities match the situation. Be judicious with the number of priorities.

There are many factors that have contributed to the sudden increase in burnout among healthcare professionals, including issues with the initial management of the virus outbreak such as rapidly increased workload hours, inadequate PPE, and a lack of consistently updated guidelines (Wang, Zhou, & Liu, 2020). Even with some of these early issues resolved, many others remain, and I join many other healthcare leaders in our concern that “the constant exposure may result in a permanent fracture in the mental health of many healthcare professionals” (Wang, Zhou, & Liu, 2020).

As leaders of healthcare organizations, we must reprioritize what is important to us at the organizational level. Trying to do and focus on too many things will overload our teams at such a fragile time for their mental health. We must listen to ensure we fully understand the essential needs of our frontline staff during COVID-19, as stressors may also exist outside work that may contribute to the feelings of powerlessness.

Navigating this pandemic brings prolific uncertainty. It is essentially impossible to get away from the constant stressors in and out of work, and even the most resilient among us are not immune to the effects of burnout. It is imperative for the long-term health of our teams and organizations that we go above and beyond to offer support and resources to our employees on a continual basis.

Resources

2020 NSI National Health Care Retention & RN Staffing Report. Published by: NSI Nursing Solutions, Inc. March, 2020.

Chowdhury, Madhuleena Roy, BA. The Neuroscience of Gratitude and How It Affects Anxiety & Grief. January 9, 2020.

Clinicians Report High Stress in COVID-19 Response. Society of Critical Care Medicine. May 2020.

COVID19: The National Order of Nurses warns of the situation of 700,000 nurses in France as the epidemic accelerates again. Ordres National des Infirmier. October 11, 2020.

Employees: How to Cope with Job Stress and Build Resilience During the COVID-19 Pandemic. Centers for Disease Control and Prevention. May 5, 2020.

Figley, C.R. (Ed). (1995) Compassion Fatigue: Coping with secondary traumatic stress disorder in those who treat the traumatized. New York: Brunner/Mazel.

Global: Amnesty analysis reveals over 7,000 health workers have died from COVID-19. Amnesty International. September 3, 2020.

Jha, Sachin “Sunny”, MD; Shah, Shalini, MD; Calderon, Michael David, MS; Soin, Amol, MD; and Manchikanti, Laxmaiah, MD (2020). The effect of COVID-19 on interventional pain management practices: A physician burnout survey. Pain physician, 23, S271-S282.

Mathieu, F., (2012) The Compassion Fatigue Workbook. New York: Routledge.

McCarthy, Niall. Where Most Health Workers Have Died From Covid-19. Statista. September 3, 2020.

Moss, Jennifer. Preventing Burnout Is About Empathetic Leadership. Harvard Business Review. September 28, 2020.

Rogers, E., Polonijo, A. N., & Carpiano, R. M. (2016). Getting by with a little help from friends and colleagues: testing how residents’ social support networks affect loneliness and burnout. Canadian Family Physician, 62(11), e677-e683.

Salazar, Alexandra. Infecting the mind: Burnout in health care workers during COVID-19. ScienceDaily. May 13, 2020.

Simmons, Micha’le. Three things executives can do to get ahead of leader burnout amidst Covid-19. Advisory Board. April 7, 2020.

Wang J., Zhou M., Liu F. Reasons for healthcare workers becoming infected with novel coronavirus disease 2019 (COVID-19) in China [published online ahead of print, 2020 Mar 6]. J Hosp Infect. 2020; pmid:32147406

Read more from Dr. Seleem Choudhury at seleemchoudhury.com

Post a Comment By

Post a Comment By  Seleem R. Choudhury |

Seleem R. Choudhury |  Thursday, November 5, 2020 at 05:05PM tagged

Thursday, November 5, 2020 at 05:05PM tagged  Clinical & Quality|

Clinical & Quality|  Trends & Strategies

Trends & Strategies