By Clive Riddle, January 13, 2022

We recently provided our own view into 2022, Scrolling Through the Roadmap of 2022 Healthcare Trends, With Sixteen Selected Stops. Now we’ve scrolled even further to see what others are saying about the coming year in healthcareland. We found five recent prognosticators from different perspectives that resonated, to share with you.

Doctor Marc Harrison, the CEO of Utah’s Intermountain Healthcare provides an excellent outline of 5 Critical Priorities for the U.S. Health Care System in Harvard Business Review. His national agenda includes:

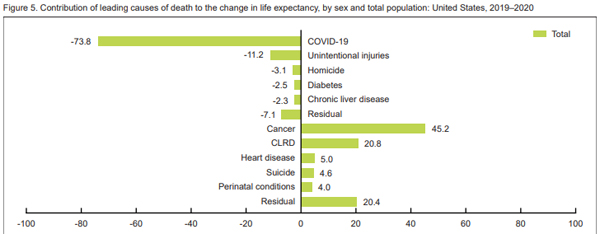

1. Focus on Improving Health (“One of the most striking aspects of Covid-19 is that it often exploits underlying chronic conditions such as diabetes, heart disease, and obesity. With these chronic conditions already at epidemic levels in America, the U.S. population has been ripe to be ravaged by Covid-19.”

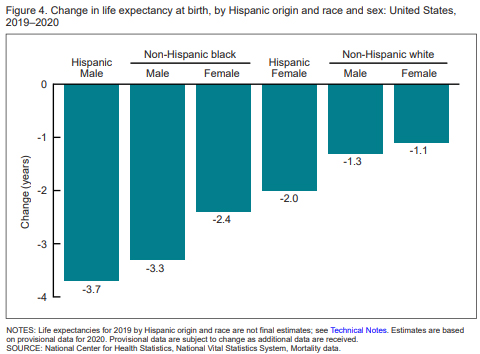

2. Tackle Racial Disparities (“The Covid-19 pandemic has starkly illuminated the profound racial disparities in health care, and these must be rapidly addressed to achieve health equity.”)

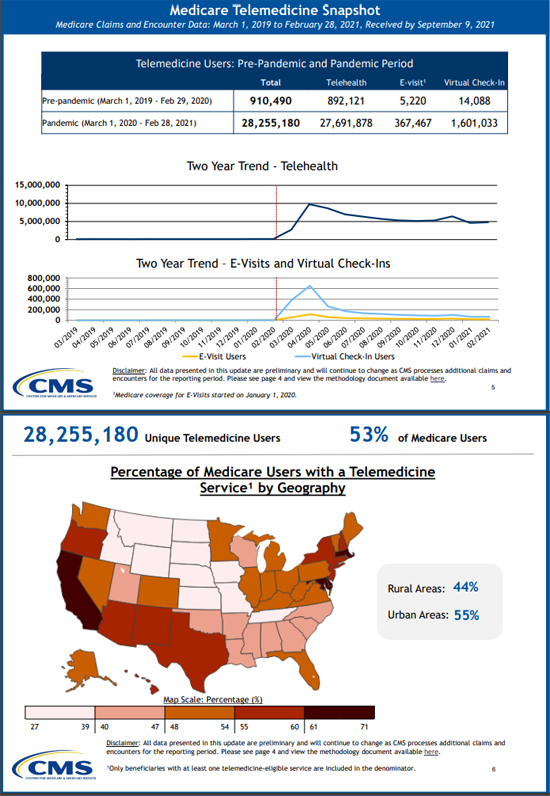

3. Expand Telehealth and In-Home Hospital Services (“In health care, we’ve long asked people to come to us for help. We need to change that thinking entirely and become more consumer-centric. We need to care for people closer to their home.”

4. Build Integrated Systems (“Another important confirmation from the pandemic is that integrated health care delivery systems — those that offer their own health insurance plan or do so via a partnership with an external insurer — are better suited to adapt and align incentives to rapidly changing circumstances.”)

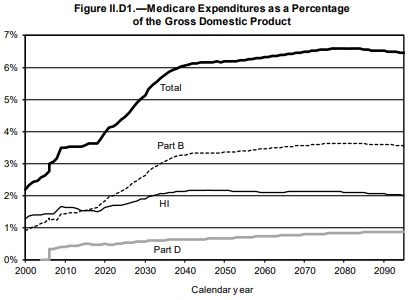

5. Adopt Value-Based Care (“The widespread acceptance of value-based care — under which providers, including hospitals and physicians, are paid on the basis of capitation and patient health outcomes — would accelerate the adoption of the above priorities.”

Cigna shared The 4 Biggest Health Care Trends of 2022 and How They Impact America’s Employers:

1. Behavioral Health Care: More Need, More Availability, and More of a Focus for U.S. Employers (Cigna saw a 27% increase in outpatient behavioral health visits in 2020 over 2019, and the trend has continued throughout 2021)

2. Working Toward Health Equity: The Role Employers Play ("Health disparities don’t stay at home when we go to work." say Cigna's Kimberly Funderburk, VP and GM for government & education)

3. Drug Costs Continue to Spark Concern for Employers (Cigna reminds us that specialty medications accounted for more than half of pharmacy spend in 2020, although only 2% of the population utilizes these drugs)

4. Virtual Care Provides Ease, Flexibility, and Can Help Foster a Healthy Workforce (Cigna notes that Pre-pandemic, less than 2% of outpatient behavioral health and medical claims were for virtual visits. Today they make up nearly 25%)

Silicon Velley’s Bessemer Venture Partners offers these 2022 Healthcare Predictions, telling us “opportunities are emerging for leaders to build the connective tissue between the physical and digital worlds in healthcare”:

1. 2022 is the year where IaaS meets digital health

2. An increased focus on hybrid care

3. As the digital health field becomes more crowded, clinical outcomes will become a key competitive differentiator

4. The great resignation poses a breaking point for the supply of clinicians

5. A tech-enabled renaissance for the independent clinician (“Emerging new platforms and tools are helping clinicians become more independent and run successful businesses by enabling flexible hours, additional revenue streams, or owning their audience.”)

6. Value on investment alongside return on investment (“Increasingly, benefit managers are now looking at social factors as well when making purchasing decisions. They are beginning to place a premium on benefits that support diversity, equity and inclusion, as well as employee satisfaction and productivity.”)

7. Teenage years for digital health

In Forbes, Dr. Anita Gupta is a C-Suite Leader from Johns Hopkins School of Medicine penned The Future Of Health: Three Healthcare Trends For 2022:

1. ESG Strategy Focused On Innovation (“The life science industry is moving toward a model of social impact focused on ESG (environment, sustainability, governance) and customized therapies for specific patient populations.”)

2. Data Analytics To Accelerate Biotechnology Innovation (“As our understanding of genetics and disease continues to evolve, the life sciences industry relies on data analytics more than ever before”)

3. Consumer-Facing Telemedicine And Digital Care Solutions (“Finding more consumer-facing solutions that are hybrid models, including both face-to-face and telemedicine, could be the future, while making telemedicine more mainstream and improving consumer access”)

And finally, GE Healthcare published this tech perspective on The Future of the Healthcare Workforce: 5 Predictions For 2022:

1: Innovation to Reduce Burnout Will Continue

2: Clinicians Will Separate the Wheat From the Chaff When It Comes to AI (“the healthcare industry will become increasingly selective about its AI. Clinicians will seek out tools that limit their time in front of a screen and reduce the number of clicks required to input data. Tools that don’t reduce the workload will be ignored.”)

3: Technology Will Help the Workforce To Reduce Healthcare Inequities

4: Telemedicine Will Become Even More Integral to Healthcare Delivery

5: Precision Health Will Revolutionize Healthcare Delivery

Share This Post

Share This Post